If you invest against the crowd, then you’re a contrarian investor.

Contrarian investing is betting against public wisdom. If most people are selling a stock, then a contrarian investor is buying. If everyone is buying, the contrarian is selling.

Some say that contrarian investing is stupid. You can’t beat the market consistently – so why bother?

Others say contrarian investing is smart. Warren Buffett famously recommends being “fearful when others are greedy and to be greedy when others are fearful”.

Is contrarian investing an effective strategy? What is contrarian investing? How does contrarian investing work? Today, we’re explaining everything you need to know about contrarian investing strategies.

What is Contrarian Investing?

Contrarian investing means to invest against the crowd. It means being skeptical of general market sentiment.

Some people are contrarian in everyday life. You might be a contrarian in politics, for example: you go against the political wisdom of the crowd. Others are contrarian when arguing: they take an opposite stance in every argument.

Are you the type who zigs when others zag? Do you question and doubt everything? When someone tells you to jump, do you say ‘no’? If so, then you may be a contrarian investor.

Contrarian investing isn’t a bad thing. Some of the world’s most successful investors are contrarians. They made their fortunes by contrarian investing. When the rest of the market was selling, contrarian investors were buying at discount prices. When the rest of the market was buying, contrarian investors were selling to maximize gains.

Contrarian investing goes against human nature. Humans are communal beings. We like being part of a crowd. If you’re more of a lone wolf, however, then contrarian investing may be right for you.

Being a smart contrarian investor isn’t about raw intelligence and independence, however. It’s about careful research and investing. If you can consistently make intelligent investments, then you can earn good returns with a contrarian investing strategy.

Below, we’ll explain:

How contrarian investing works

How to implement contrarian investing strategies

How to maximize gains and reduce risks with contrarian investing

Undervalued investment ideas for 2020

Average Investors Underperform Every Investment Class

One of the most important things to note about contrarian investing is that it can be very effective.

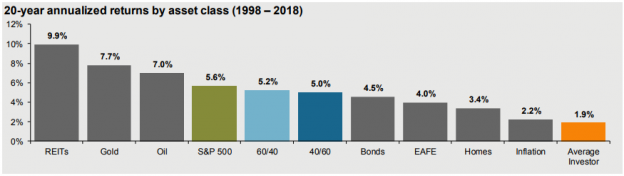

That’s because the average investor is much dumber than you think. In fact, one study by Dalbar Incorporated found that the average investor underperforms nearly every investment asset.

Over a 20 year period (1998 to 2018), the average investor experienced annualized gains of 1.9%. In comparison, the S&P 500 had annualized gains of 5.6%, REITs jumped 9.9%, and inflation rose 2.2% per year during that same time period.

JP Morgan charted the results here:

Why does the average investor perform so poorly compared to other markets? Because the average investor often focuses on the short-term instead of long-term.

The study found average investors sell underperforming assets and buy overperforming assets, for example. That may sound good, but it can be an ineffective investing strategy.

Let’s say one stock isn’t performing well. The average investor sells that stock when it’s low, then buys another stock that’s surging. The average investor is selling low and buying high, which is never a good investment idea.

A contrarian investor works differently. A contrarian investor buys low and sells high.

Contrarian Investing Does Not Guarantee Gains

To this point, we’ve discussed contrarian investing as a good thing. Contrarian investing seems like an effective way to maximize gains and minimize losses in any market.

Of course, that’s not true. Contrarian investing can also lead to huge losses. Sometimes, betting against the market is not a good idea. In many cases, the market is right.

When you bet against the crowd, you’re betting that everyone else is wrong – but you’re right.

If you’re a genius with inside knowledge, then you might be right, and you may generate huge returns. If you’re wrong, however, then you lose money. You invested in a dying market or product. The company declared bankruptcy after everyone expected it to declare bankruptcy. You lost your money.

Sometimes, the market isn’t wrong. Over time, the S&P 500 has outperformed many of the world’s top hedge funds. That means putting $1,000 into a fund tracking the S&P 500 would have been smarter than putting that money into some of the world’s top hedge funds.

Value Investing is a Contrarian Strategy

You may have heard of value investing. Value investing can be a contrarian investing strategy. Warren Buffett used value investing to become one of the most successful investors in history:

“I will tell you how to become rich. Close the doors. Be greedy when others are fearful, and fearful when others are greedy.” – Warren Buffett.

With value investing, you invest in solid companies when others are selling those companies. You sell companies when others are euphoric.

In a downturn, some of the world’s largest and most successful companies are affected. Some of those companies will not survive the downturn. Other companies, however, will survive and reach new heights after the downturn. If you can consistently identify those winning companies, then you can become an effective value investor.

As a value investor, you see value where others do not. You also avoid expensive companies that others love.

Warren Buffett has created a career out of investing in highly-profitable companies at rock-bottom prices. He has bought stocks when others were fearful.

We could mention individual stock picks from Warren Buffett, including stocks he bought at rock bottom prices. You can find plenty of examples of Buffett’s genius stock picks online.

However, we saw one of the best examples of Warren Buffett’s contrarian investing strategy in the 1990s. In the late 1990s, when everyone was buying tech stocks and markets were surging, Buffett instead purchased 130 million ounces of silver at rock bottom. Silver was close to a historical low point. Months later, the Dot Com bubble burst and silver surged.

Buffett was similarly successful in the 2008 downturn. As the financial sector collapsed, Buffett rescued some of the best financial companies, signing them to profitable contracts that would pay off enormously if markets ever recovered (which, of course, they did).

Being on the wrong side of the majority isn’t necessarily a bad thing.

Effective Contrarian Investors Invest in What They Know

Warren Buffett and other successful investors recommend investing in what you know. It sounds obvious, but investing in what you know can be an effective contrarian investing strategy.

Let’s say you work in a highly specialized field. The market is aware of your field, and the market has a broad understanding of how that field works. However, the average investor does not understand the nuances of your field – like the potential directions your field will go in 5 or 10 years.

When you invest in what you know, you can get an advantage over the market. It may be a contrarian strategy, but it can be an effective strategy (assuming you know your stuff).

Similarly, investing in what you don’t know can cause problems. The market might be pouring into a field – like pot stocks, for example. You don’t understand the marijuana business, but you know it’s the next big thing. After all, more states are legalizing it. Why wouldn’t it become big? Of course, the general market feels the same way, and pot stocks may be overvalued.

By investing in what you know, you can beat the market with contrarian investing strategies.

Using Contrarian Investing to Balance your Portfolio

You can also use contrarian investing to balance your portfolio.

At any time, certain parts of your portfolio will be overvalued, while others will be undervalued. Sell your overvalued assets, then buy more undervalued assets. You’re balancing your portfolio, protecting against losses, and maximizing gains.

Let’s say you have multiple social media stocks in your portfolio. You believe these stocks are overvalued.

At the same time, you have oil stocks in your portfolio. Oil has taken a hit lately, and you believe oil stocks are undervalued.

You sell some of your overpriced social media stocks, then buy undervalued oil stocks with the proceeds.

You have balanced your portfolio while swapping assets, taking profit at market highs and capitalizing on market lows.

This is contrarian investing. The market has pushed social media stocks to all time highs. The market keeps buying social media stocks. At the same time, the market is pushing oil stocks to record lows. The market continues to sell oil stocks.

You might not see the results of this strategy in the near future, but the long-term benefits can be huge. Over time, this contrarian investing strategy can minimize risk and maximize gains – assuming you correctly identified overvalued and undervalued stocks.

Contrarian Investing Doesn’t Have to Be High Risk, High Reward

When some people hear about contrarian investing, they assume it’s a high risk, high reward investing strategy.

This can be true in some situations but not others. All investing is risky, but contrarian investing can be as high risk or low risk as you like.

Sometimes, contrarian investing can be very risky. Let’s say a company is rumored to be bankrupt. Everyone sells, and shares plummet. You buy the dip, and the company later declares bankruptcy. You’ve lost your investment.

In other cases, everyone sells that company because it’s rumored to be close to bankruptcy. You buy at near-zero prices, and the company comes back from the edge. You reap huge rewards.

Investing in certain financial companies during the 2008 crisis, for example, was considered a risky contrarian investment. The entire industry collapsed, and many of America’s largest banks closed. However, some survived and generated huge returns for investors.

In other cases, contrarian investing doesn’t have to be high-risk. Some people hedge their bets by taking a short position, for example. Others arrange financing deals with lucrative payoffs and Some simply use stop loss orders to limit losses.

All investing is risky. Contrarian investing, however, can be as high-risk or low-risk as you like.

Tips for Contrarian Investing

If you’re the next Warren Buffett, and you’re a master trader with years of proven experience, then this guide isn’t for you.

If you’re an average investor seeking to maximize returns over time, however, and achieve solid performance, then contrarian investing could be an effective approach.

Here are some tips for average investors seeking to implement contrarian investing into their strategy:

Leave shorting to professionals. Shorting is the ultimate contrarian strategy. A short position can lead to huge gains – or huge losses. Instead of buying a healthy but undervalued company, you’re betting against a broken company. Many of the hedge funds that use shorts underperform the S&P 500. These hedge funds have endless access to analysts and research. Do you really think you can do better?

Avoid margin trading. Margin trading, like shorting, can lead to huge gains or huge losses. Margin trading can help you capitalize on a once-in-a-lifetime opportunity, although it can also cause you to lose more than you initially invested. It’s suited for advanced contrarian investors – but not average or beginner contrarians.

Pick companies with economic durability. Good companies prepare themselves for economic downturns. They may face losses, and they may face challenges, but they ultimately survive. Smart contrarian investors pick companies with economic durability. Pick a company with a moat.

Pick companies with unique advantages. What advantages does a company have over its competition? Why will this company survive the next recession – but its competitors won’t? If you invest in a company that survives a recession while its competitors fail, then you’ve setup your portfolio for success. Unique advantages could include brand strength, network effects, cost advantages, prime real estate locations, patents, or regulated monopolies.

Learn how to analyze. The average investor spends 5 to 10 minutes Googling a stock before deciding whether or not to buy. Smart contrarian investors know how to read and analyze companies, looking beyond headlines and hype.

Steer clear of debt. A good company might have created a buffer between itself and market conditions, but some companies still sink because they have too much debt.

Diversify. The first rule of any investing strategy is to diversify, and contrarian investing is no different.

Contrarian Investing in 2020: Today’s Best Undervalued Investment Ideas

In today’s market, there are undervalued and overvalued assets. If you can identify which assets are which, then you can reap rewards as a contrarian investor.

Some investment ideas floating around contrarian investing communities in 2020 include:

Developing Markets: Some parts of the world have been hit hard by the coronavirus, experiencing sharp drops in manufacturing, tourism, and other sectors. Some of these countries will inevitably bounce back. While some are selling developing markets, others believe they’re undervalued.

Oil & Gas: Oil and gas stocks have been hit hard in recent years, and 2020 has been one of the worst years in recent history. OPEC has engaged in price wars. The United States almost went to war with Iran. Oh, and a global pandemic pushed air and road travel to historic lows. At one point, oil futures were negative, which means people were getting paid to accept barrels of oil. It’s been a tough year for oil and gas, but contrarian investors may see value.

Pot Stocks: Pot stocks have had a tumultuous history since 2015. They were initially undervalued, which sent them skyrocketing to historic highs. Over the last few years, most of the largest pot producers have been overvalued, with some top companies losing over 90% of their value. However, marijuana isn’t going away, and some believe these pot producers are undervalued in 2020. Contrarian investors might find value in growers, distributors, and retailers.

Brick-and-Mortar Retailers: The coronavirus pandemic has sent online sales skyrocketing. Many physical retailers have been hit hard. Some have even declared bankruptcy. The future of shopping may be online, but contrarian investors might find opportunity in brick-and-mortar retailers with physical retail outlets.

Cruise Lines: Cruises have been understandably hit hard by the pandemic. Nobody is taking cruises, and that inevitably affects business. Contrarian investors are betting that cruise lines like Carnival Corp (CCL) recover.

Airlines: Global air travel has plummeted, and some airlines won’t survive this pandemic. Contrarian investors are buying airline stocks to capitalize on historic buying opportunities.

Commercial Real Estate and REITs: Many companies have gone remote, and that means less demand for commercial real estate and office space. Commercial real estate and commercial REITs have dropped, but contrarian investors might see an opportunity.

Final Word

Some argue that it’s impossible for average investors to beat the market year after year. Of course, there are plenty of people with decades of proven experience beating market returns – so contrarian investing can certainly be effective.

Contrarian investing can beat the market. Or, contrarian investing can fail. Betting against the market isn’t a guarantee of success – far from it.

However, with careful research and intelligent investing, contrarian investors can make more good trades than bad trades, maximizing gains, minimizing losses, and building an effective investment portfolio.